unemployment insurance tax refund

The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. 2021 Taxable Wage Base Base per worker will remain at 10800 per worker.

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. This tax break was applicable. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. Generally for a refund to be approved the money that caused the credit must have been paid at least 21 days prior and the credit must be larger than your average quarterly tax due. The vermont department of taxes has begun issuing refunds to eligible taxpayers who received unemployment insurance benefits last year and electronically filed their 2020 vermont individual income tax returns prior to the federal.

This will reduce your FUTA contribution rate to 060 600 - 540. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check.

Because there is a possibility that you may want to request a refund we will send this letter to your place of business rather than to your 3rd party agent. Kentucky employers are eligible to claim the full FUTA credit of 540 when filing your 2020 IRS 940 forms in January 2021. If the IRS has your banking information on file youll receive your refund via direct deposit.

The IRS has sent 87 million unemployment compensation refunds so far. You do not need to take any action if you file for unemployment and qualify for the adjustment. Many are relying on that.

File wage reports pay taxes more at Unemployment Tax Services. This taxable wage base is 62500 in 2022 increasing from 56500 in 2021. Experience tax currently capped at.

Request a refund of the credit balance on our unemployment insurance tax account. Billion for tax year 2020. Recalculations - We have completed recalculating your UI tax amount for 1st quarter 2022.

The IRS has estimated that up to 13 million Americans may qualify. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. People might get a refund if they filed their returns with the IRS before.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. According to the IRS the average refund is 1686. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010.

The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. IRS sending tax refunds to 28M Americans who collected unemployment aid. See How Long It Could Take Your 2021 State Tax Refund.

This is available under View Tax Records then click the Get Transcript button and choose the. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

Updated March 23 2022 A1. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Another way is to check your tax transcript if you have an online account with the IRS.

The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year. For some there will be no change. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020.

Mobile Menu Issues. Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. An unemployment tax refund is a portion of the taxes you pay to your states unemployment insurance ui program.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less. An estimated 10 million people will receive the unemployment insurance tax refunds as part of the American Rescue Plan signed into law by President Joe Biden in March.

Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. In the latest batch of refunds announced in November however the average was 1189.

Will I receive a 10200 refund. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. They dont need to file an amended tax return.

We will also send you a letter notifying you that your UI tax amount has been recalculated. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. File Wage Reports Pay Your Unemployment Taxes Online. President Joe Biden signed the pandemic relief law in March.

Otherwise youll receive a paper. There are some exceptions though. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax rate and adjust previously filed wage reports.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands. If youre married and filing jointly you can exclude up to 20400. The FUTA taxable wage base remains at 7000 per worker.

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

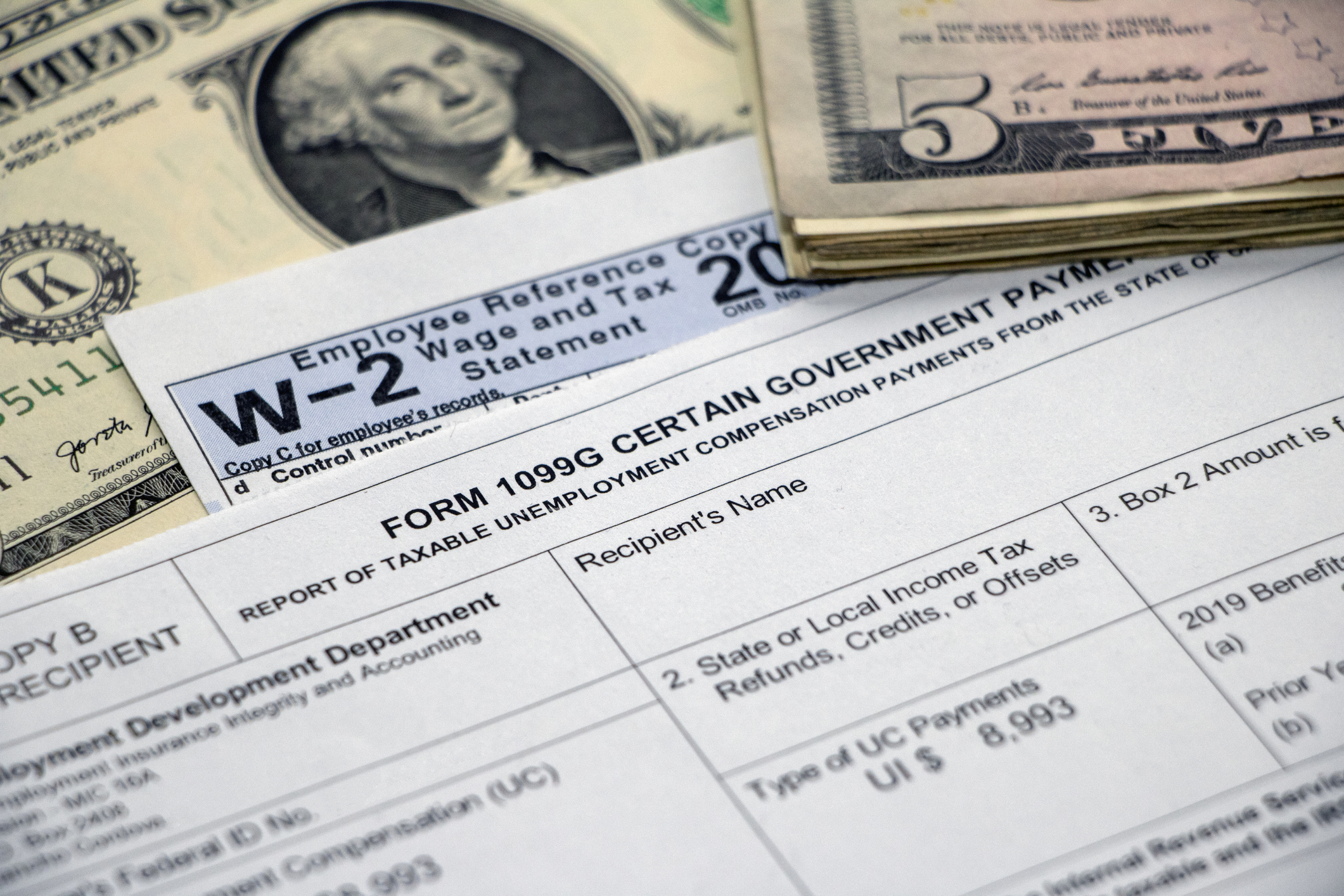

1099 G Unemployment Compensation 1099g

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Confused About Unemployment Tax Refund Question In Comments R Irs

Irs Unemployment Refunds Moneyunder30

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Sending Out Another 1 5 Million Tax Refunds To People Who Overpaid On Unemployment Benefits Cbs News